Join Online Investment Bootcamp to learn smart investing in 2 months!

- Extensive hands-on practice

- Develop practical investment skills

- Top instructors

NO LOANS & CREDITS

2,000+

students from Eastern Europe have started a new career

Features

- Make sure to join the training program by February 5th!

- Projects in portfolio

- Manage assets smartly

- Boost your earning potential

About This Bootcamp

Gain vital essential investment skills

and confidently grow your portfolio

Investors focus on growing their wealth by analyzing market trends and making strategic decisions. A well-built portfolio helps reduce risk and take advantage of changing market conditions for profit

During this bootcamp, you’ll learn how to evaluate market trends, build diversified portfolios, and develop strategies that adapt to economic shifts while minimizing risks

Acquiring these skills empowers you to make informed investment decisions, improve your portfolio’s performance, and confidently navigate changing market conditions

Online Bootcamp Requirements

Fluency in English

All classes and communication are conducted in English. Please ensure that you can comprehend explanations during lectures and practice sessions.

6–8 hours/week

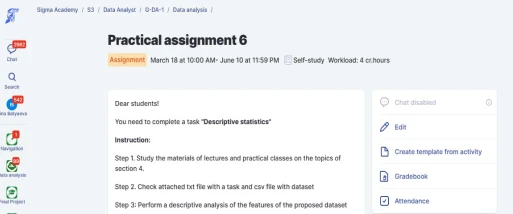

You’ll need at least 6–8 hours per week to successfully study the bootcamp. This amount of time includes attending lectures, webinars, self-study of provided materials, and completing assignments.

Internet

We offer online education, so you’ll need an Internet connection to participate in live training sessions and access bootcamp materials.

Sigma Academy is not a lending or financial institution and does not provide loans to individuals or businesses. Only high-quality educational services

Who Will Benefit from the Investment Bootcamp

Fast Track to Investing: Master Smart Investments in 4 Steps

-

Learn

onlineGain essential investment skills through interactive lessons on our learning platform. Get personalized feedback from experienced instructors and curators

-

Build Practical Experience

Develop a personalized portfolio with practical exercises. Gain confidence by applying investment strategies in real-world scenarios

-

Optimize Your

InvestmentsReceive guidance on portfolio improvement and risk management. Learn how to make informed, time-efficient investment decisions

-

Achieve Your

Financial GoalsUnlock your potential by using smart strategies to grow your wealth and secure your financial future

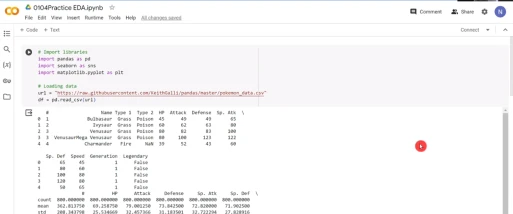

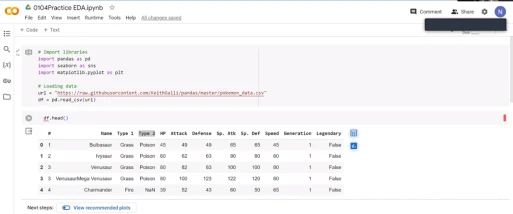

Inside Our Training: How It All Works

What Is Sigma Academy?

Our bootcamps, developed by expert methodologists and instructors, prepare students to excel in today’s competitive job market.

Originating in Eastern Europe, Sigma Academy has evolved into an international online academy, collaborating actively with Kenya and other African countries.

-

8,9

Average Bootcamp Score from students

-

20+

Career Advancement Guides

-

30+

Professionals on staff

-

87%

Students employed

Our mission is clear: to provide affordable, high-demand digital and IT education to empower young people in Sub-Saharan Africa, fostering positive change in the region

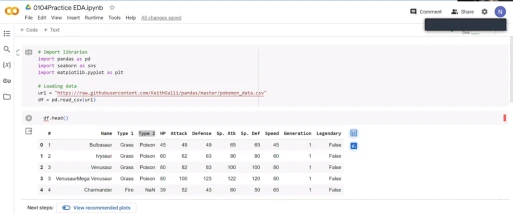

I want to studyCurriculum with 75% of practice

Online

Format144 hours

In totalFrom scratch

Level2 months

Bootcamp duration8 hours

Per week

Good Day! I am Ricky Omondi

Course Program — “Investment”

Basics of Investment Literacy

- Analyze your budget and determine the financial goals you want to achieve

- Create your risk profile and figure out how much money is needed to start investing

- Learn about inflation and compound interest

Structure of Stock Markets

- Understand key participants: organizers, brokers, managing companies, depositories

- Learn how to check participant licenses, and select brokers

- Explore different account types, commissions, and top broker ratings

Trading Applications

- Discover various services for stock trading and learn how to use them

- Open an individual investment or brokerage account

Financial Instruments

- Study financial instruments: stocks, bonds, mutual funds, ETFs, futures, and options

- Choose securities based on your risk profile and financial goals

Strategies for Working with Financial Instruments

- Learn about trading, margin trading, long/short positions

- Explore different investment strategies and create your own

- Learn to build and rebalance your securities portfolio

Bond Selection

- Learn about different types of bonds and their pricing

- Analyze and compare bonds using ratings and independent financial sources

- Build your bond portfolio

Fundamentals of Fundamental Analysis

- Explore different types of stocks and learn how to select them

- Understand "blue chips" and financial multipliers

- Perform fundamental analysis and calculate stock value

Selecting Dividend Stocks

- Conduct market analysis and find companies paying dividends

- Learn about shareholder registers and how to access them

- Study strategies for working with dividend stocks

Asset Management

- Explore various types of exchange-traded funds (mutual funds, ETFs)

- Understand their pros and cons and select suitable ones

- Learn about stock market indices and benchmarks

Basics of Technical Analysis

- Learn to perform basic technical analysis of international stocks

- Understand price charts, timeframes, candlesticks, trend lines, and moving averages

- Get a technical analysis checklist for reading price charts

Investor Information Field

- Learn how to make financial decisions and adjust your portfolio based on news

- Study analytical reports from investment houses and verify the reliability of information sources

Taxes and Tax Benefits

- Learn about the rights and responsibilities of investors

- Report investment income and understand tax rates and benefits

- Get a list of documents needed for filing a tax return

Prove Your Skills

Every graduate receives a certificate

of completion

Our certificates state what you learned and how long

the training lasted. Employers are more likely to choose

professionals who can prove their skills with an educational

document.

Besides, these certificates act as important credentials,

showcasing your dedication to ongoing learning and

advancement in your career journey.

Your Investment Skillset

28 y.o.

Nairobi, Kenya

Key skills:

- Setting financial goals and investment strategies

- Evaluating risks and potential returns

- Building and managing an investment portfolio

- Understanding how the international stock market operates

- Buying and selling securities effectively

- Opening accounts and reporting for taxes

- Selecting financial instruments for various objectives

- Identifying reliable brokers and avoiding scams

- Analyzing stock market indices and financial news

Career Pathways

Full course fee

Course fee with discount

54,000 KSHPrepayment:

10% - 5,400 KSH

10% off if you make full payment:

45,000 KSH

FAQ

I’ve never invested in securities before. Will I be able to do it?

Yes, you will be able to master investing, even if you have no prior experience. Just make sure to dedicate time to practice and ask questions if needed. The knowledge and skills gained from the bootcamp will help you build your portfolio and complete your first stock market transactions.

Will you recommend which stocks to buy?

This course is not an investment recommendation. We teach the fundamentals of investing. You’ll learn how to analyze securities, choose brokers, and manage a portfolio. With this knowledge, you’ll be able to decide which stocks align with your goals.

What document will I get when I finish the bootcamp?

After completing the training, you’ll receive a certificate that includes details about the bootcamp duration and the subjects you’ve studied.

How long does the training last? How long does it take per week?

Our programs last for 3–5 months. All lectures are available in the recording, so you can plan the schedule yourself. You need 8–12 hours per week to study.

Is it possible to study using my phone?

While you can watch classes on a smartphone or tablet, practical assignments require a laptop or PC. These assignments involve using specialized software not compatible with mobile devices.

Who will instruct me?

Our instructors are experienced professionals who have a minimum of 5 years of expertise in their respective fields. Under their guidance, you’ll acquire the essential knowledge and improve your skills through hands-on tasks.

For how long will I get access to the bootcamp?

You’ll have 3 years of access to the program materials.

Will I get help during the bootcamp?

Of course. Our mentors assist in all cases and instructors review assignments and answer questions to guarantee you comprehend the materials.

Can I pay in installments?

Yes, we offer flexible payment plans. Our representatives will offer the best option for your situation.

Your Bootcamp Package

-

- 2 months

- Pay with M-PESA

28,000 KSH (full price)

Flexible payment plan before the start

Make a full payment — save extra 10%

-

Creation of a personal investment portfolio

-

Analysis of 3 market-shifting case studies and performance metrics of 3 companies

-

Workshop “How to get an offer to top international companies”

-

Workshop “How to study effectively online”

-

Ongoing support and feedback from instructors and mentors

-

Career Center assistance: CV, resume, portfolio, HR advice

Apply now

Sign up for the online bootcamp to

get a consultation and a webinar about skills for digital professions.

Get a bonus

After submitting your application, you will get a bonus — 10 useful materials for a future Data Analyst. The materials will be automatically downloaded.

*Please make sure you provide accurate information so that our representatives could reach out to you.

- NO LOANS & CREDITS

- Interest-free installment

- Experienced instructors

- Project in portfolio

- Pay with M-PESA